Where Real-Time Meets Risk-Free

24/7 USD settlement for crypto institutions built on regulated banking rails and a uniquely safe, yield-generating deposit model.

Uniquely Safe Settlement Network, Powered by T-Bills

Organic T-Bill Yield

Funds are auto-invested in government-backed T-bills, earning the “risk-free” rate, while remaining fully accessible for real-time settlement.

Reduced Counterparty Risk

No intermediaries, commingling, or balance sheet exposure ensures the safety of every dollar settled and stored on the network.

Frictionless Operations

Real-time API-first architecture integrates and scales with crypto-native operations to help eliminate cutoff windows, onboarding delays, and operational drag.

Regulated Infrastructure

JikoNet is anchored by Jiko’s nationally chartered bank and registered broker-dealer, ensuring compliant onboarding, and proper oversight of all transactions on the network.

Bringing U.S. T-bill access onto an always-on platform is an important step in how markets evolve. Jiko’s approach and technology are a good fit with the pace at which we’re building, and we’re pleased to support Coinbase’s investment in Jiko through the JikoNet platform.

Roger Bartlett

VP, Institutional at Coinbase

Our mission at Bitso is to provide millions across Latin America with faster, safer, and more accessible financial services. Jiko’s U.S. T-bill-backed rails bring a level of safety and efficiency that elevates how we serve our customers every day. From onboarding to ongoing settlement, Jiko’s technology and responsiveness have exceeded expectations, and we’re excited to deepen this collaboration.

Imran Ahmad

General Manager of Bitso Business

Partnering with Jiko helps strengthen our infrastructure, thanks to its security, liquidity, and 24/7 availability. Their unique model allows for yield generation while minimizing counterparty risk. At Crypto.com, we’re focused on building a more resilient digital economy, and Jiko’s unique approach aligns with our vision.”

Joe Anzures

General Manager, Americas and EVP of Payments at Crypto.com

Leading digital asset platforms choose Jiko to power safe, always-on storage and settlement

Jiko recently announced strategic backing by Coinbase and Blockstream Capital Partners. Alongside this investment, Jiko is entering new strategic partnerships with leading industry players, including Crypto.com, Blockstream Capital Partners, Bitso, and Coinbase. These strategic partners will join a growing number of institutions adopting Jiko as a banking partner to utilize its U.S. T-bill-based model for storage, settlements, and payments.

Crypto Settlement Solutions Built to Last

Today’s crypto leaders are hampered by banking rails that weren’t built for digital markets; while the crypto world moves in milliseconds, the fiat world takes days.

Addressing the digital asset industry’s core challenges

Balance sheet risk

Jiko’s unique model holds customer funds in T-bills, eliminating balance sheet or capital ratio risks

Legacy banking infrastructure

Modern technology platform with simple API integration for scalable, real time operations

Compliance requirements

All network participants are KYB’d customers at Jiko Bank, with BSA/AML requirements met on all transactions

Idle cash

Network participants earn the "risk free" rate of T-bills from the second funds arrive

Onboarding and operational friction

Quick onboarding driven by transparent requirements and white glove service

24/7 Secure Fiat Settlement for Crypto Institutions

Download the JikoNet Crypto Factsheet to discover how Jiko is uniquely structured to solve the digital asset industry's pain points around real time fiat settlement.

Where T-Bill Safety Meets Crypto Speed

100% Bank

Nationally chartered bank and FINRA-registered broker-dealer

100% Tech

Real-time APIs and automated flows

100% Delevered

No lending, no balance sheet risk, no commingling of funds

Recommended Reads

Connecting Fiat and Crypto: Using T-Bills to Build a Safer, 24/7, Yield-Bearing Settlement Network

A new Coindesk feature explores how Jiko is solving the structural disconnect between fiat and digital asset systems with a T-bill-backed, 24/7 settlement network for crypto institutions.

Read more →

Crypto Markets Don’t Sleep, Safety Shouldn’t Either

A recent article in The Block highlights how JikoNet Crypto provides secure real-time settlement without counterparty exposure or bank delays.

Read more →

Reflections from TOKEN2049 Singapore: Building Safer, Smarter Infrastructure for Digital Finance

Across panels and side conversations, one message was clear: crypto has entered a new chapter. Innovation is moving quickly, and expectations around safety, regulatory clarity, and institutional-grade infrastructure are higher than ever.

Read more →Frequently asked questions

JikoNet Crypto is a real-time settlement network purpose-built for the digital asset industry. It enables 24/7 movement of U.S. dollars between participants using “Jiko Pockets,” with cash positions immediately invested in T-bills in the recipient’s name, allowing participants to benefit from the safety and security of T-bills while earning yield.

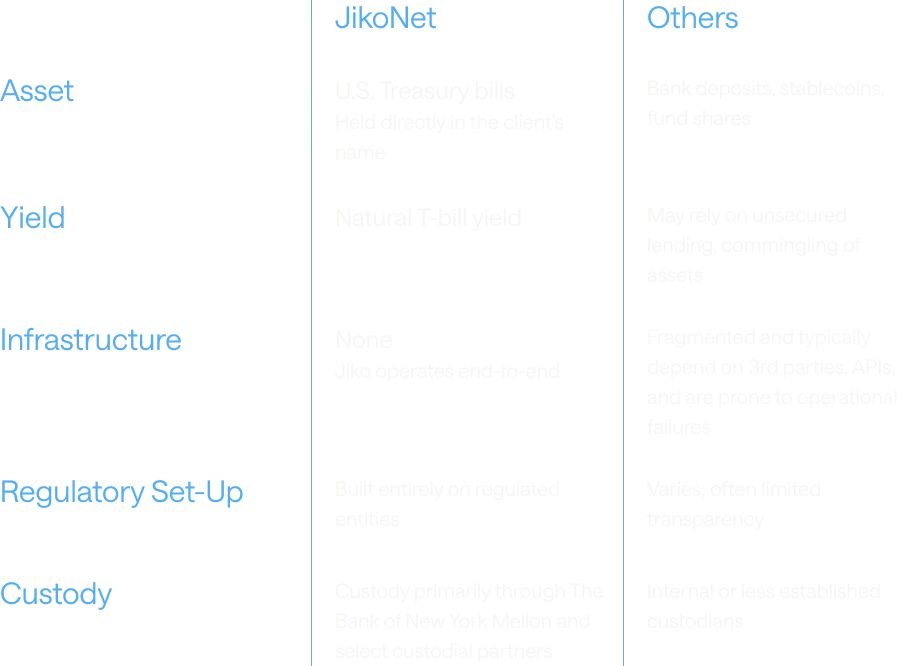

Counterparty Risk: Jiko owns and operates both a regulated national bank (Jiko Bank) and a FINRA-registered broker-dealer (Jiko Securities, Inc.), with asset custody primarily through The Bank of New York Mellon and select custodial partners, ensuring full control and transparency across the entire stack.

Balance Sheet Risk: Clients own T-bills directly in their name. Jiko does not engage in lending or rehypothecation; client assets remain safe, liquid, and are always earning the yield of T-bills.

Compliance & Trust: JikoNet Crypto is a regulated settlement platform, purpose-built to meet the operational, regulatory, and audit needs of the crypto industry.

Settlement Speed: By operating outside of traditional correspondent banking rails, JikoNet Crypto enables near-instant movement of funds, reducing delays, settlement risk, and operational risk.

Transfers across Jiko Pockets occur in real time and are available 24/7, including weekends and holidays. Jiko Securities is a carrying broker with FINRA that operates 24/7 to buy and sell T-bills from Jiko clients. Money movement occurs on the bank’s ledger, and all resulting cash positions are immediately swept into T-bills.

Funds are transferred across Jiko Pockets, which combine a bank account and a brokerage account.

When a transaction is initiated from one Pocket to another, Jiko facilitates an instant on-us transfer by liquidating the sender's T-bills, sweeping the proceeds to the receiver’s Pocket as cash, and investing the funds in T-bills on behalf of the receiver, all in real time.

Yes. While transfers are internal to Jiko’s infrastructure, APIs and integration options allow interoperability with custodians, exchanges, and enterprise platforms.

JikoNet is open to:

Exchanges

Market makers

Custodians

OTC desks

Crypto-native platforms

All participants must pass Jiko’s onboarding, KYC/AML, and regulatory compliance checks.

Connect with Jiko

Learn more about JikoNet Crypto and connect with Jiko to get the information you need to join the subnetwork.