US Treasury Bills: Automated Trading & Payment Capabilities

Direct access to the safety and yield of T-bills, owned by clients and managed by Jiko, combined with the payment capabilities of an operating account.

What Is Jiko?

Jiko is a fintech-powered, federally regulated national bank and broker-dealer that auto-invests client deposits into US T-bills for 100% safety, liquidity, and real-time yield.

Deposit

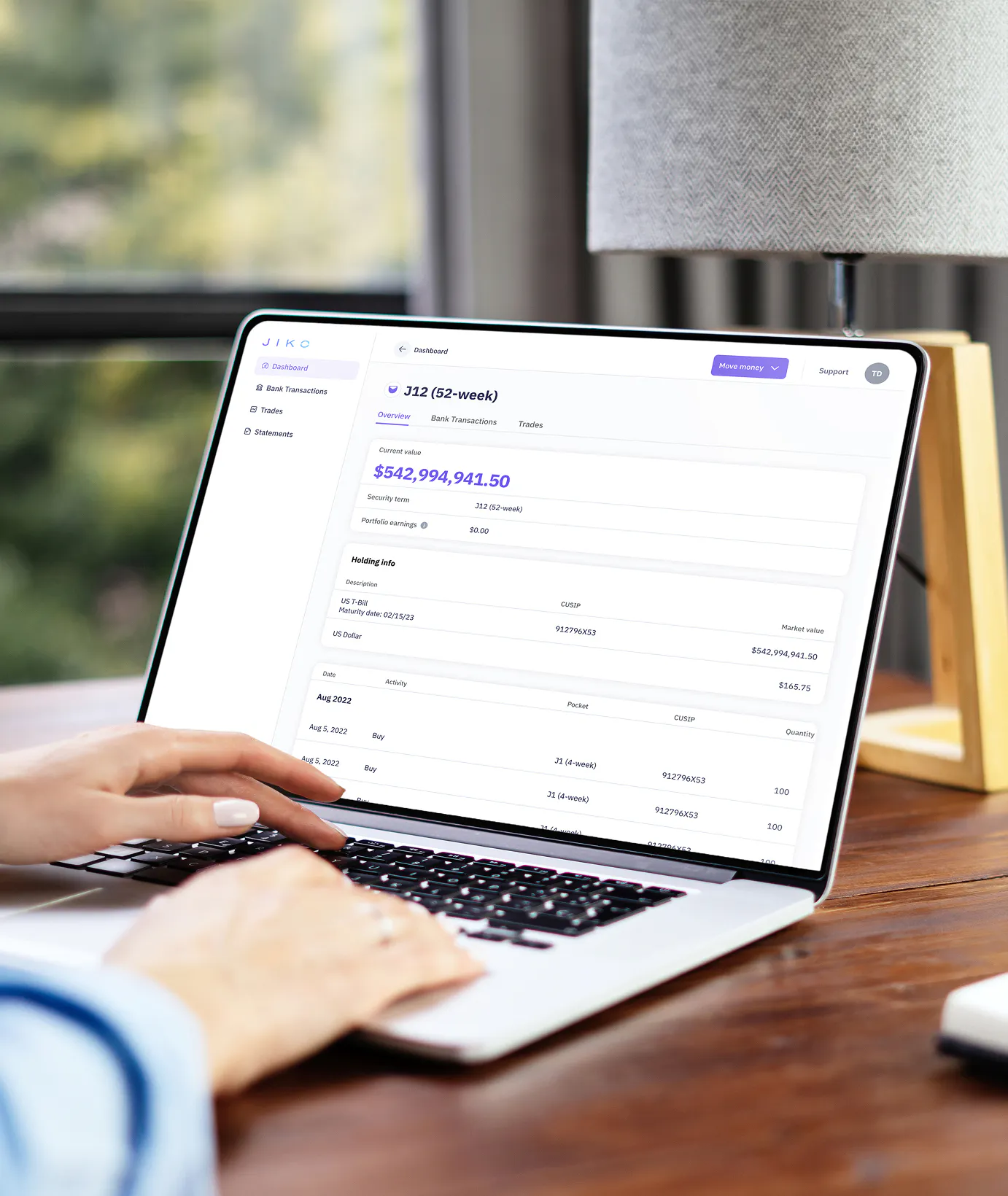

Funds deposited at Jiko are immediately swept and invested into US T-bills of the client's choosing, owned directly (with CUSIPs in their name)

Earn

Clients earn the “risk-free” rate of T-bills and are automatically reinvested at maturity

Liquidate

Clients can initiate a transaction from Jiko’s platform, triggering immediate liquidation (24/7) and sweep to Jiko Bank for rapid settlement

Why Institutions Choose Jiko

Delevered Deposit Model

Clients maintain the same payment and operating account functionality that a traditional bank offers, without being exposed to the liquidity risks of a traditional bank’s leveraged structure.

Uniquely Safe Structure to Preserve Liquidity

Jiko provides clean and transparent ownership structure and chain of custody to ensure timely access to cash, even in the most extreme liquidity events.

Automated and Frictionless Trading

Access the yield and safety of direct T-bill investment without the operational burden of trading, rolling, and managing T-bill positions.

Competitive Returns Backed by the US Treasury

When tax exemptions are factored in, T-bill yields have historically met or exceeded net returns from large government and treasury money market funds.

“We achieved high returns, low fees, and safety, and were not fearful of unexpected expenditures requiring unplanned liquidations because the funds are liquid. Their T-bill platform is easy to master, their customer service and response times are top notch, and their dashboard is well designed for statements, transactions, and trades.”

Mark Sheahan — Treasurer, Thornton Township Trustees of Schools

Read Success Story