Positioning Cash for Market Resilience and Operational Readiness

In a recent webinar hosted by Strategic Treasurer, Jiko’s CEO Stephane Lintner and Head of Product Xavier Audibert joined Craig Jeffery for a practical briefing on how treasury teams can strengthen their 2026 strategies to best position cash to ensure obligations can be met under any market condition.

Key Topics of Discussion

Liquidity and counterparty exposure during moments of market stress

Structural risks behind common short-term cash instruments

U.S. Treasury bills as a safe and liquid asset when owned directly

Watch the full webinar recording here.

Building a Resilient Cash Strategy in 2026

A strong strategy ensures liquidity can be accessed regardless of market conditions. With projections showing slowed global growth, rising inflation , and the potential for continued interest rate cuts, implementing a resilient cash strategy remains a strategic priority for treasurers in 2026.

A resilient cash strategy ensures positions can not only be liquidated promptly and without loss, but also takes into consideration payment layers so financial obligations can be met even in periods of extreme volatility or disruption. As liquidity issues can emerge suddenly and escalate quickly, taking a proactive approach and stress testing strategies can help treasury teams avoid a disaster scenario.

Lessons From Past Liquidity Shocks

The webinar panel reviewed recent crisis events to assess liquidity causes and consequences from even the largest financial institutions, including the 2008 financial crisis, where multiple large banks in the US (e.g., Lehman, Wachovia, Merrill Lynch, and Washington Mutual) experienced severe liquidity stress that led to bankruptcy, forced acquisitions, or regulatory seizure.

Beyond the banks, systemic pressure quickly spread to non-bank financial institutions. AIG required a government bailout, and the Reserve Primary Fund “broke the buck,” revealing the systemic risks of commingled funds and undercapitalized counterparties.

The events of the 2008 crisis highlight how quickly liquidity can evaporate and how fast contagion can spread even for major institutions.

When the financial markets get shaken, you just don't know which institution will hold. When you do stress testing, you really want to look at all the different wrapping structures and eliminate them if you can, and then really start thinking about where the money is eventually going to come from when I have to make a payment.

Stephane Lintner

CEO & Co-Founder, Jiko

Considerations for Building Resilience

With so many priorities to balance, finding the resources to conduct a stress test and scenario plan for a liquidity crisis can be difficult.

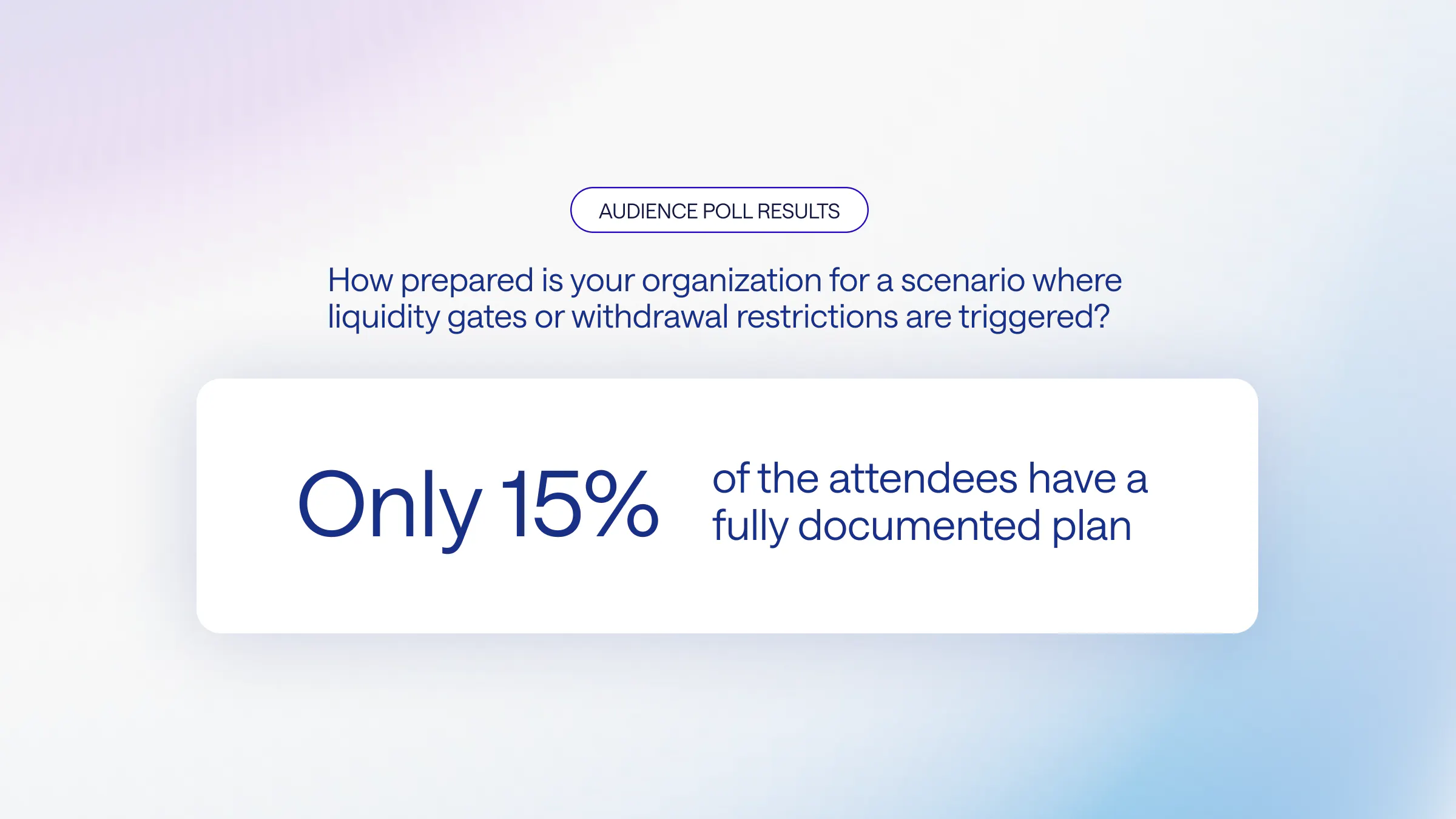

In fact, a poll of treasury and finance professionals who attended the webinar revealed that only 15% have a fully documented plan when asked how prepared their organization is for a scenario where liquidity gates or withdrawal restrictions are triggered. A simplified assessment should start with evaluating three core risks:

Asset-level risk

It’s critical to review and understand which instruments maintain liquidity under stress.

Counterparty risk

Regardless of asset liquidity, access to cash is subject to the solvency and operational status of the institutions and intermediaries involved.

Operational risk

Similarly, every transaction depends on layers of infrastructure functioning as intended. Wire rooms, settlement partners, or liquidity desk failures can disrupt payments.

Direct Ownership of U.S. Treasury Bills (T-Bills)

When evaluating how to build resilience into a cash strategy, T-bills can play a distinct role as one of the safest and most liquid assets available:

Backed by the U.S. government

Traded in one of the deepest and most liquid markets in the world

Short duration with low price sensitivity

Transparent, with clear pricing and settlement mechanics

T-bills, held directly, can help limit counterparty risk and offer a clear and resilient path to preserving access to cash. However, since T-bills are securities, they can be cumbersome and inefficient for treasury teams to trade and manage directly.

Challenges of T-Bill Trading:

Brokers taking cuts through spreads or execution markup

Inconsistent or opaque pricing that affects realized yield

Manual entry errors and cutoff risk during trade submission

Frequent rollovers that create idle cash and reinvestment gaps

Confirmations and reconciliation steps that add operational overhead

Re-keying data into treasury management systems

Brokers and treasury platforms can provide access, but often lack transparency into execution and workflow automations. That’s where Jiko comes in.

The idea that you could use T-bills as an ultra-short-term cash resilience solution for cash management is new because historically, it's been an opaque and complex market designed for the large banks and brokers to trade large amounts of liquidity amongst each other.

Stephane Lintner

CEO & Co-Founder, Jiko

Jiko Pockets: T-Bill Operating Accounts and Real-Time Payments

Jiko is a regulated financial platform made up of a national bank and registered broker-dealer that solves the challenges of T-bill accessibility. Its core offering, the Jiko Pocket, is effectively a T-bill operating account that seamlessly combines the transactional capabilities of a bank operating account with fully automated investments in T-bills.

Funds held in Jiko Pockets are invested programmatically by autonomous T-bill agents in ultra-short-term T‑bills in the client’s name, with full transparency into positions, pricing, and execution, giving treasury teams clear visibility into where cash sits at any given moment. Funds are automatically and continuously invested in T-bills until cash needs to be accessed or a payment must be made. In that event, T-bill agents liquidate positions to cover the cost of the transaction, sweep the proceeds into Jiko Bank, and initiate the transaction (e.g., wire, ACH, on-us transfer), all in real time.

That's a pretty interesting development, we believe, to take advantage of the T-bill environment and the benefits while reducing the friction side.

Craig Jeffrey

Founder & Managing Partner, Strategic Treasurer LLC

Clients can segment funds across multiple Pockets, designating them for specific entities or purposes to support more advanced treasury operations.

Because Jiko operates as both a regulated bank and broker-dealer, the entire flow (from investment to payment) happens within Jiko’s de-levered infrastructure. This eliminates the need for intermediaries and minimizes operational dependencies that often create points of failure during market stress.

While no financial system can remove all counterparty exposure, this architecture materially reduces the number of intermediaries involved in converting assets into payments, limiting the operational and institutional risks that most often delay access to cash when it is needed most.

JikoNet: Real-Time Payment Network

Jiko clients can go one step further to strengthen their ability to meet financial obligations through JikoNet, a 24/7, real-time settlement network for Jiko clients.

Even with a strong cash strategy, a treasury team might be unable to settle a payment with a critical vendor if the payee’s financial institution is offline or unable to process a transaction. Treasurers can avoid this risk (that would otherwise be out of their control) by ensuring all critical payees are on JikoNet, where they can settle instantly, minimizing exposure to external wire rooms or bank failures.

Learn More

Jiko Pockets and JikoNet offer a structurally safe and operationally efficient architecture for managing and mobilizing corporate cash, enabling treasury teams to hold cash in T-bills while maintaining reliable liquidity.

Access the full webinar session, Why T-Bills Matter Now: Positioning Cash for Market Resilience and Operational Readiness, on demand to get the full insights. Be sure to get in touch with the Jiko team to discuss your specific challenges and needs.

Further reading

Preparing for the Fed’s Next Move: Why Treasurers Should Care

The July 2025 Fed meeting gave a rare glimpse of dissent. The result of the September FOMC meeting? The Fed cut its key interest rate by 25 basis points and is pricing in other potential cuts this year. For treasurers, this isn’t just noise. Rate moves ripple across every cash instrument, from T-bills to money market funds to deposits. Preparedness is key: you can’t control the Fed’s path, but you can control how you position your cash.. Read more →

Make Every Basis Point Count: Building a Reliable & Resilient 2026 Cash Strategy

As planning season begins, treasurers are facing a complex landscape heading into 2026. In this 30-minute virtual interview, Jiko's Rachel Green sits down with family office CPA and University of Miami professor Lenny Gravier to discuss how to design a resilient cash management strategy for 2026. Lenny draws on his experience of helping family offices and corporates in balancing yield, visibility, tax efficiency, and control.. Read more →

Beyond the Bank Account: T-Bill Agents and the Future of Treasury

Jiko CEO & Co-founder Stephane Lintner explores the structural frictions in corporate cash management and how autonomous T-bill agents could reshape how treasurers manage liquidity, safety, and strategy at scale.. Read more →