4 Mistakes Treasurers Need to Avoid When Investing in a Money Market Fund

What Are Money Market Funds?

Money Market Funds (MMFs) are a type of mutual fund that invests in short-term, relatively liquid financial instruments. The primary goal of MMFs is to offer investors a stable and safe place to maintain cash while simultaneously earning a modest return. However, investors can still make common mistakes when deciding to invest in MMFs.

Common Mistakes to Avoid When Investing in MMFs

1. Assuming All Money Market Funds Are the Same

Money Market Funds come in various types, each with different risk profiles and investment strategies. With such diversity in underlying assets, investors must recognize that not all Money Market Funds carry the same risks. As an investor, it is important to understand the risks associated with each fund before investing. Here are the most common types of Money Market Funds.

Treasury Funds

Invest primarily in U.S. Treasury securities and repurchase agreements (repos) collateralized by Treasuries. These funds typically carry the lowest credit risk since Treasuries are backed by the full faith and credit of the U.S. government.

Government Money Market Funds

Similar to the Treasury MMF, these funds primarily invest in short-term government securities like T-bills and repos, but also include other government-related instruments. Hence, the Government MMF is also generally viewed as a safe and most reliable option with minimal risk.

Municipal Money Market Funds

These fund types invest primarily in short-term debt issued by state and local governments (such as municipal bonds or notes). Municipal MMFs are attractive to investors who seek tax advantages. This is because the interest income earned from Municipal MMFs is often exempt from federal income taxes, and if applicable to the investor’s residence, sometimes even exempt from state and local taxes. In exchange for these tax advantages, Municipal MMFs typically may yield slightly lower returns compared to other types of money market funds because of the tax exemptions.

Prime Money Market Funds

These fund types invest in a more expansive range of short-term, low-risk debt instruments. Securities in this fund type include commercial paper (corporate-issued), certificates of deposit, and repurchase agreements. Prime MMFs are typically considered low-risk, but the risk is slightly higher than that of government or municipal funds due to their exposure to the creditworthiness of financial institutions and corporations. However, in times of market stress or economic uncertainty, these funds may experience more volatility, as the credit risk of corporate issuers may rise. Prime MMFs are a good choice for investors who are seeking to maximize short-term returns while still maintaining a relatively safe investment and are comfortable with a bit more risk.

2. Not Reviewing the Prospectus and the Fund’s Underlying Assets

A fund’s prospectus provides crucial details regarding the fund’s investment objectives, strategies, fees, risks, and underlying assets. It is required to be provided to all investors before an investment is made. It’s important for investors to review the fund prospectus as it provides the information needed in order to ensure that the fund meets the investor’s goals and aligns with the investor’s risk tolerance. Reviewing the fund’s underlying assets is vital to understanding the fund’s risk profile. Some key areas of focus in reviewing a fund’s underlying assets include:

Credit Quality of Assets

Credit quality is an estimate of the issuer’s ability to pay back its debt obligations. It is typically determined by credit ratings, which are provided by independent agencies such as Moody’s, Standard & Poor’s (S&P), and Fitch. Ratings help to evaluate the risk associated with investing in a particular security. Higher credit quality typically means lower risk. In contrast, a lower credit quality generally introduces higher risk.

Asset Allocation

We previously discussed the types of Money Market Funds available, whether they are government-only, Municipal MMFs, or Prime MMFs. Each provides a different range of securities for different investor needs. With each fund, it is important to review the underlying assets that make up the fund. To reiterate, here are a few types of securities that may be offered in a MMF:

Banker’s Acceptance: Short-term debt instruments that are guaranteed by a bank

Certificates of Deposits: Short-term deposits issued by banks

Commercial Paper: Short-term debt issued by corporations

Municipal Debt: Short-term debt issued by Municipalities

Repurchase Agreements: Short-term loans collateralized by securities

U.S. Treasury Bills: Short-term debt instruments issued by the U.S. government

It is important to understand the securities that make up the fund and to be comfortable with the risk that may be associated with them.

Fund Performance

Investors can also review how the underlying assets have been performing. The fund’s prospectus typically provides a snapshot of the fund’s historical performance over a set period of time. Investors can review yields to see if the fund is performing in line and generating competitive returns. However, with any investment, it is important to remember that past performance is not indicative of future returns.

3. Ignoring Expense Ratios

The expense ratios of Money Market Funds are generally low in comparison to other Mutual funds. This is due to their conservative investment strategies and prioritization of short-term and low-risk investments. With the relatively low-cost reputation that Money Market Funds have, investors can easily make the mistake of not paying attention to the fund’s expense ratio. Funds with higher expense ratios can quickly and easily cut into returns over time, especially if the yield is already low to begin with. Investors can diminish this risk by researching and choosing funds with a lower expense ratio. This will assist in ensuring their return is not greatly impacted by higher fees. Here are the general ranges of expense ratios for each type of MMF:

Treasury MMFs

Treasury MMFs typically have the lowest expense ratios due to their simpler investment universe and potential for less complex fund management.

Government MMFs

While on the low-end, Government Money Market Funds may have higher expense ratios than their Treasury counterparts because of the need to manage a slightly broader range of investments and potentially more complex fund structures. It’s important to note that government money market funds may invest in repurchase agreements, which are typically not exempt from state tax and are not obligations of the US government, so it’s important to check the detailed holdings of the individual fund.

Municipal MMFs

Municipal MMFs generally have relatively low expense ratios since their focus is on short-term municipal securities. These types of funds are relatively simple to manage but do come with the added complexity of tax considerations. Municipal MMFs typically have substantially lower expected returns but are often exempt from tax, so they may only be appropriate for entities in a high tax bracket.

Prime MMFs

Prime Money Market Funds typically have the highest expense ratio when compared to Government and Municipal MMFs. As its investment strategy offers a broader range of securities, investors should expect their funds to require more analysis and management. Prime MMFs typically have slightly higher expense ratios.

While the expense ratios of all of these funds are relatively low, investors should pay attention before investing to maximize their overall return.

4. Focusing Solely on Liquidity

Liquidity is one of the main advantages of Money Market Funds. Investors expect to easily buy and sell shares without much delay and without significant price fluctuations. This is expected as MMFs aim to provide a stable Net Asset Value (NAV) of $1 per share. That means investors generally expect to redeem shares at $1 per share. Although the fund’s aim is to maintain the $1 NAV, it is not a guarantee, and the NAV can fall below $1.

This instance is referred to as “Breaking the Buck”. Breaking the buck can happen when an MMF’s investment income fails to cover losses on its investments and/or its operating expenses. This is more likely to occur when interest rates fall to extremely low levels or if a fund uses leverage, which creates capital risk.

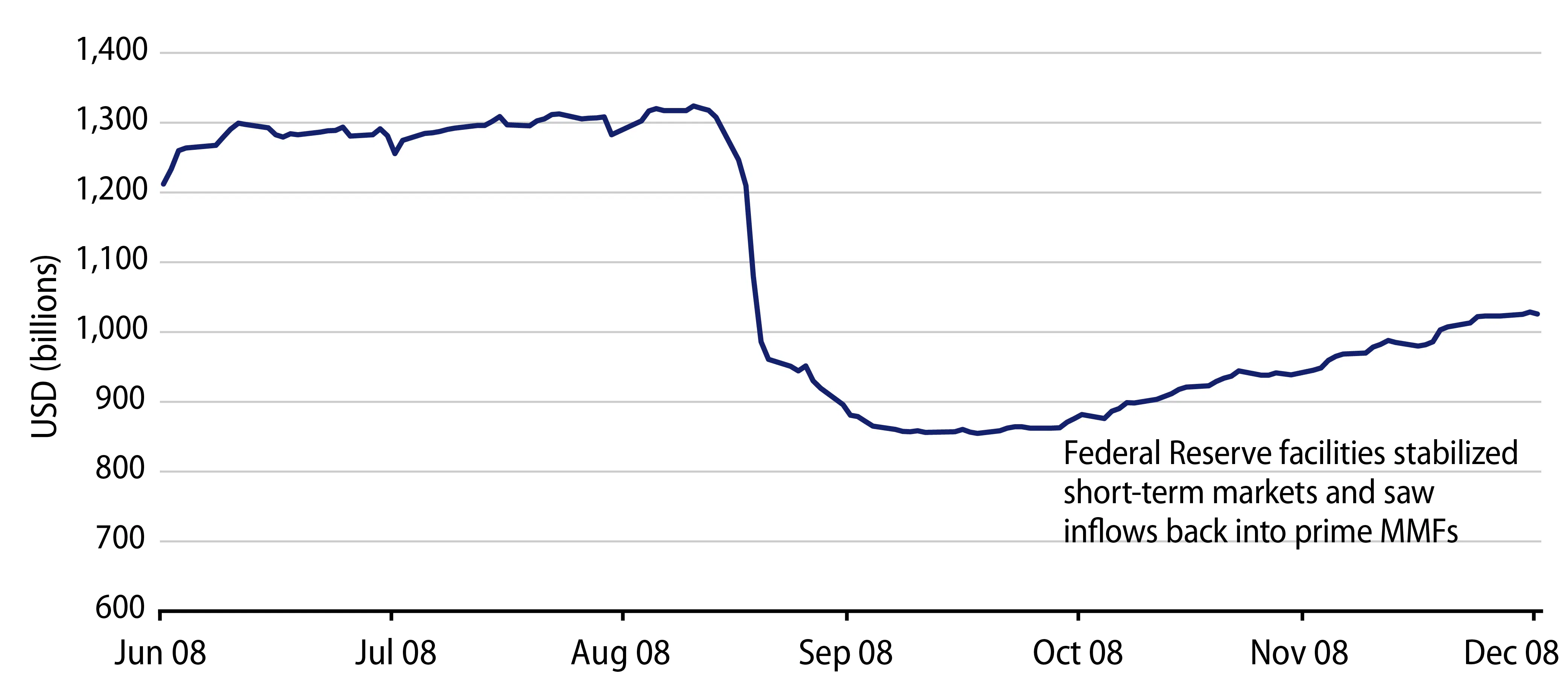

Historically, breaking the buck has happened during times of financial crisis and market stress. For example, during the 2008 financial crisis, the Reserve Primary Fund’s NAV fell under $1 per share when the Lehman Brothers filed for bankruptcy. The Reserve Primary Fund had held only 1.5% of its securities in Lehman Commercial paper, but when the bankruptcy filing occurred, those loans became worthless, thus causing the fund’s overall NAV to fall below $1. Investors in the Fund were concerned about the remaining holdings in the fund and quickly began pulling out money, which caused the fund’s assets to decline drastically in just 24 hours.

2008 Lehman bankruptcy effect on Prime MMF outflows (Source: WesternAsset)

Redemption fees may be imposed if investors withdraw funds from the MMF within a short period after investing, especially during times of market stress (especially if the fund holds illiquid assets). These fees are typically charged when the fund is facing stress due to frequent redemptions and/or larger outflows, and are more prevalent in actively managed funds.It is important for investors to examine the fund’s liquidity policy so they can confirm that the fund aligns with their needs.

Conclusion

Money Market funds can be a great investment option for investors seeking lower-risk, short-term investments. It is important for investors to educate themselves and to ensure that the fund they are investing in is a good overall fit for their needs. Carefully reviewing a fund’s prospectus and gathering as much information on the fund will help investors determine if the fund meets their demands and are comfortable with the risks associated.

Directly investing in Treasury bills (T-bills) may be a more suitable option for treasurers prioritizing safety and liquidity, and who prefer to avoid the credit risks of Money Market Funds and the ways they react to interest rate movements. Unlike MMFs, T-bills do not carry counterparty risk, as they are fully backed by the U.S. government. This ensures greater security and eliminates exposure to private financial institutions that could face distress during economic downturns. For a deeper analysis of how MMFs compare to T-bills in terms of risk, read our risk comparison of Money Market Funds vs. T-bills.

Moreover, T-bills continue to offer competitive returns while ensuring liquidity and capital preservation, making them a compelling alternative for treasurers seeking a more secure and predictable cash management strategy. Or even a safe and liquid destination for cash to earn yield while treasurers go through the process of evaluating different MMFs.

Further reading

Understanding the Risks of Money Market Funds Compared to T-Bills

Priorities 1a and 1b for treasurers managing corporate cash are safety and liquidity. While yield is a close second, the returns generated on funds are generally thought of as a value add. In evaluating where to allocate cash, treasurers must carefully weigh risks versus rewards, with Money Market Funds (MMFs) and U.S. Treasury bills (T-bills) being two of the most popular vehicles for a healthy balance.. Read more →

How Treasury Bills and Money Market Funds React to Falling Interest Rates

The Federal Reserve adjusts interest rates as a primary tool to manage inflation, support economic growth, and maintain financial stability. Read more →

A Guide to Properly Evaluating Money Market Funds Before Allocating Corporate Cash

Money Market Funds (MMFs) are one of the most widely used tools for managing short-term cash while earning short-term yield, but not all MMFs are created equal. With varying fund types, investment strategies, and levels of credit exposure, it’s critical to evaluate each option carefully. Treasurers need to ensure the fund they choose aligns with their organization’s cash strategy, risk tolerance, and operational needs. This guide outlines a structured approach to help you do just that.. Read more →