Understanding the Fundamentals of Treasury Bills: A Comprehensive Guide

Treasury bills (T-bills) are a cornerstone for cash management, providing security and predictable returns backed by the U.S. government. From individuals to large institutions, investors of all sizes rely on T-bills to preserve capital and maintain liquidity in any economic environment. This guide explores the fundamentals of T-bills, including how they work, how they compare to other investments, and how they fit into an overall investment or cash management strategy.

What Are Treasury Bills (T-Bills)?

Treasury bills are short-term debt securities issued by the U.S. Treasury. Unlike bonds and notes, which pay periodic interest, T‑bills are sold at a discount to face value and redeemed at full face value upon maturity. The difference between the purchase price and the face value represents the return. Because they are backed by the full faith and credit of the U.S. government, they are considered virtually “risk-free”.

T-bills differ from other U.S. Treasury securities in their maturity lengths and payment structures. Treasury Notes (T-Notes) have maturities ranging from two to ten years and pay interest every six months, while Treasury Bonds (T-Bonds) mature in 20 or 30 years and also pay interest semiannually. Another category, Treasury Inflation-Protected Securities (TIPS), offers protection against inflation by adjusting the principal value based on changes in the Consumer Price Index (CPI). T-bills stand apart as the shortest-term option, with maturities ranging from a few weeks to one year. The return is predictable and reflects the rate at the time of purchase.

One of the most common questions from investors is whether T-bills pay interest. While they do not provide traditional interest payments, the discount pricing mechanism effectively delivers a yield equivalent to an interest-bearing security.

How Do Treasury Bills Work?

T-bills are available in maturities of 4, 8, 13, 17, 26, and 52 weeks, providing flexibility for various investment horizons.

T-bills are issued through a government auction process, where investors can participate using either competitive or non-competitive bids. In a competitive bid, the investor specifies the discount rate they are willing to accept. If the bid is better than the discount rate set in the auction, the order is filled. Otherwise, the order could be partially filled or rejected. In a non-competitive bid, the investor agrees to accept the discount rate determined at auction and guarantees the order is filled.

T-bills can also be purchased and sold on the secondary market, allowing investors to buy them outside of the initial auction process. The secondary market provides liquidity and flexibility, making it easier for investors to enter or exit positions before maturity. When purchasing on the secondary market, investors should be aware of "on-the-run" versus "off-the-run" T-bills. On-the-run bills are those recently auctioned by the US Treasury and are typically the most liquid. All other Treasury securities are considered ‘off‑the‑run’ and may trade with wider bid‑ask spreads in the secondary market. Understanding these distinctions can help investors make informed decisions when buying or selling T-Bills outside of the primary auction process.

Treasury Bills vs. Other Investments

Treasury Bills Versus Money Market Funds

Money Market Funds (MMFs) are investment vehicles that pool money from investors to buy a diversified portfolio of short-term debt instruments, including T-bills, commercial paper, and repurchase agreements. While MMFs provide convenience and professional management, they come with risks and costs that differentiate them from T-bills.

MMFs may hold a variety of short-term debt instruments, some of which carry credit risk from corporate or municipal issuers. While these funds aim to maintain a stable net asset value (NAV), there have been instances where MMFs "broke the buck," meaning their NAV fell below $1 per share due to financial distress, leading to liquidity issues for shareholders of the fund. In contrast, T-bills are fully backed by the U.S. government, making them virtually “risk-free.”

Cost is another factor to consider. MMFs charge management fees, which can reduce net returns over time, especially in a low-interest-rate environment.

Treasury Bills vs. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are fixed-term deposits offered by banks and credit unions that pay a predetermined interest rate over a set period. When a CD is purchased, it functions as an agreement to keep money deposited at the bank until the maturity date in exchange for a fixed return. Aside from both having a defined maturity at the initial purchase or deposit, T-bills and CDs are structurally different.

The primary difference is liquidity. Treasury bills can be sold on the secondary market before maturity, allowing investors to access their funds quickly, without penalty. CDs, in contrast, often carry early withdrawal penalties, making them a far less flexible option for Treasurers.

Another crucial distinction is counterparty risk. T-bills are backed by the full faith and credit of the U.S. government, making them virtually "risk-free." CDs, however, are subject to the financial stability of the issuing bank. Banks are leveraged institutions, meaning depositors bear more risk than they would with a government-backed security like a T-bill. Additionally, CDs may be callable, meaning the bank has the right to terminate them before the stated maturity date, potentially altering the expected return for the investor.

Comparing Treasury Bills, Bonds, and Notes

Understanding Treasury Bill Rates & Yields

Treasury Bill Rates and Federal Reserve Policy

Like other debt securities, T-bill prices fluctuate due to macroeconomic conditions, monetary policy, and market supply and demand. The Federal Reserve adjusts the federal funds rate, which is the interest rate at which banks lend to one another overnight. When the Fed raises interest rates, T-bill yields typically rise, making them more attractive to investors. Conversely, when the Fed lowers rates, T-bill yields typically decline, reducing their return but still maintaining their security advantage over other investments. The supply and demand of Treasury securities also impact their pricing, with high investor demand lowering yields and weaker demand increasing them.

Treasury Bill Yields and Discount Pricing

T-bills are issued at a discount to their face value, meaning investors purchase them for less than their stated maturity value. The rate of return on a T-bill is determined by the difference between the purchase price and the amount received at maturity.

There are two common yield calculation methods used in the market: Discount Yield and Bond Equivalent Yield.

Discount Yield is based on 360 days in a year, following the market practice for quoting the yield for T-bills. The use of 360 for the days in a year is a convention developed before calculators were readily available, but the dealers still use this method for quoting T-bill yields.

Bond Equivalent Yield (or Coupon Equivalent Yield) is used to compare the annual yield to bonds that pay periodic interest on an equivalent basis.

Example

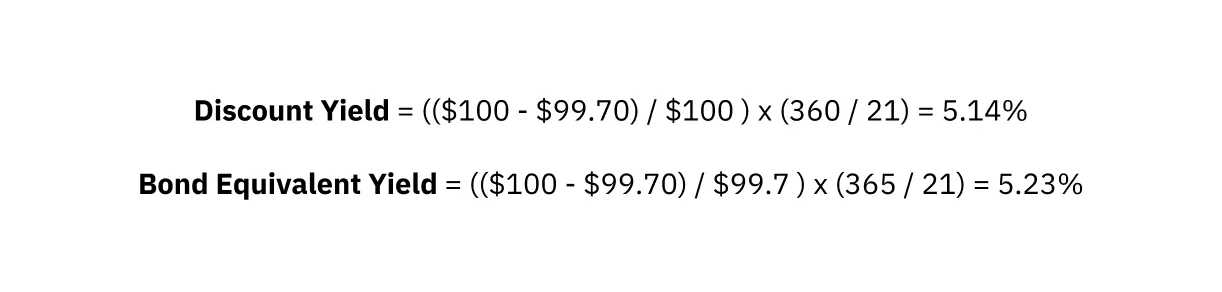

Suppose that on Friday, November 17th, you purchase a T-bill maturing on December 12th, at a price of $99.70 per $100 of par value. The number of days to maturity is calculated from Monday, November 20th, the next regular settlement date. Therefore, there are 21 days to maturity. In this scenario, you would have the following:

Par Value: $100

Price: $99.70

Day Count: 360

Days to Maturity: 21

Discount Yield and Bond Equivalent Yield are as follows:

How to Buy Treasury Bills

Investors can purchase T-bills through multiple channels, each with its benefits and drawbacks.

TreasuryDirect is a government-run platform that allows individuals and businesses to buy T-bills directly. While it eliminates brokerage fees, it requires manual investment management and offers limited integration and automation.

Brokerage accounts offer another option, allowing investors to buy and sell T-bills through financial institutions. These platforms provide convenience and liquidity but may come with additional fees and less flexibility in reinvestment strategies.

Jiko provides a modern alternative by enabling direct, automated access to T-bills with on-demand liquidity through traditional banking rails and integrating with cash management platforms. This approach removes inefficiencies found in traditional purchasing methods, giving treasurers a seamless T-bill management experience.

Learn more about the differences between these platforms: How to Buy Treasury Bills.

The Role of T-Bills in Investing and Cash Management

The key to effective corporate cash allocation is balancing safety, liquidity, and yield. T-bills fulfill this requirement by ensuring capital remains secure while generating returns that often exceed traditional business savings accounts. By incorporating T-bills into a corporate cash strategy, treasurers can optimize liquidity management, protect against counterparty risk, and maximize efficiency in capital allocation. In today’s evolving financial landscape, this approach ensures that businesses maintain both security and financial agility.

Tax Considerations for Treasury Bills

Treasury bills provide tax advantages that make them a preferred investment for many individuals and corporate treasurers. Unlike other fixed-income investments, the interest earned on T-bills is exempt from state and local taxes, making them particularly attractive for investors in high-tax jurisdictions. This tax exemption can lead to higher after-tax returns compared to alternatives such as corporate bonds or bank deposits, which are fully taxable at all levels.

At the federal level, T-bill earnings are subject to income tax and are reported on IRS Form 1099-INT. Because T‑bills are sold at a discount and don’t pay periodic interest, investors realize returns at maturity, so taxes are due when the T‑bill matures, not annually.. This feature can offer tax-deferral benefits for investors managing their taxable income.

For a more detailed breakdown of T-bill tax benefits, including comparisons to other investments, read How Treasury Bills Offer Tax Benefits for Smarter Cash Strategies.

Jiko: Making T-Bills Simple, Safe, and Liquid

At Jiko, we’ve reimagined the way Treasury bills are accessed and used—not just as an investment vehicle, but as a foundational tool for modern cash management. Our innovation lies in making T-bills simple, safe, and liquid for treasury teams and finance leaders. Through Jiko’s platform, client funds are directly invested in U.S. Treasury bills and held in the client’s name, while remaining instantly available for transactions through Jiko Pockets. Because we operate as both a nationally regulated bank and a registered broker-dealer, we’re able to offer real-time access to T-bill liquidity without compromising safety or control.

Conclusion

Treasury bills are a safe, liquid, and government-backed cash equivalent that is well-suited for both individual and institutional investors. Their short maturities, “risk-free” returns, and exemption from state and local taxes make them an attractive choice for those seeking safety and yield from their cash.

For those looking to optimize their T-bill investments, choosing the right purchasing method is crucial. To explore a seamless way to manage cash with T-bills, consider Jiko’s platform for automated, direct access to these secure assets.

Interested in learning more? Get in touch with our team.

Further reading

Tariffs, Treasuries, and Turbulence: Why T-Bills Still Stand Strong

A look at early April’s market volatility, shifting Treasury yields, and why T-bills remained a stable, reliable home for cash amid uncertainty.. Read more →

How Treasury Bills and Money Market Funds React to Falling Interest Rates

The Federal Reserve adjusts interest rates as a primary tool to manage inflation, support economic growth, and maintain financial stability. Read more →

The 3 Mistakes Corporate Treasurers Are Making When Buying Treasury Bills Directly from a Broker

The savviest treasurers, including Warren Buffet, know that holding core cash in T-bills offers the safest risk profile for risk-free returns. Read more →