How to Buy U.S. Treasury Bills – A Guide for Corporate Treasurers

Efficiently managing corporate cash is a top priority for corporate treasurers, and it involves a combination of capital preservation, liquidity, and generating returns. U.S. Treasury bills (T-bills) are a trusted cash equivalent to keep cash and maintain liquidity. This guide explores exactly how treasurers can go about purchasing T-bills, and the advantages of each method.

Understanding The Basics of U.S. Treasury Bills

A Treasury bill (T-bill) is a short-term U.S. government debt obligation backed by the U.S. Department of the Treasury. T-bills are issued at a discount from the par value, and the return on investment is realized when the bill matures, and the investor receives the full face value. Maturity terms range from 4 to 52 weeks and are auctioned regularly.

T-bills are widely regarded as one of the safest investments because they’re backed by the U.S. government. Unlike other “cash equivalents” like commercial paper, T-bills do not carry credit risk since they are issued by the most reliable entity, the U.S. government, and are not exposed to any other counterparties. This makes them particularly valuable for corporate treasurers seeking a secure place to park excess cash.

Key Advantages for Corporate Treasurers

Safety

T-bills are backed by the full faith and credit of the U.S. Treasury and carry minimal risk due to the low likelihood of government default.

Liquidity

T-bills are highly liquid, meaning that they can be sold or redeemed almost instantly in the secondary market without a significant impact on price. This is crucial for treasury teams that need quick access to funds in case of unexpected operating expenses.

Returns

Last year, U.S. Treasury bills reached their near 20-year high in yield, reflecting a risen rate environment. This yield increase made T-bills an even more attractive option for corporate treasurers seeking a safe and profitable way to park cash. T-bills offer the ability to "lock in" a rate, providing certainty and predictability for cash management, especially when compared to other short-term cash alternatives like Government Money Market Funds that feature a variable rate depending on fund performance and fees.

Tax Advantages

In addition to their competitive yields, T-bills also have the advantage of being exempt from state and local taxes, helping maximize after-tax returns for investors.

Where to Buy Treasury Bills: The Pros & Cons of Each Option

In the past, the Treasury would hold in-person auctions where investors could. Now, fortunately, all Treasury bill transactions are done electronically through the following platforms.

TreasuryDirect

TreasuryDirect is the US government’s platform that allows businesses to purchase T-bills directly from the U.S. Treasury.

To purchase Treasury bills on TreasuryDirect, you need to create an account by selecting an entity type and inputting information like a TIN, address, and bank account details. Once the account is open, buy orders can be placed directly from the platform, with payments typically done through funds transfers from the bank account linked at the time of account creation. When purchasing, treasurers can specify the amount to invest and the maturity date or period.

Aptly named, TreasuryDirect gives treasurers access to T-bills without a broker facilitating trades and taking a fee for the effort. However, while the platform provides a cost-effective way to invest in T-bills, there are limitations.

TreasuryDirect Noteworthy Limitations

$10 million limit per auction: In a single auction, a bidder can buy up to $10 million in bills by non-competitive bidding. Large corporations needing to allocate larger volumes will need to make multiple purchases and manage multiple CUSIPs.

No built-in treasury integrations or reporting capabilities: Unlike other platforms, TreasuryDirect does not offer features that integrate with corporate treasury management systems.

User interface: The TreasuryDirect platform requires a level of trading sophistication to operate.

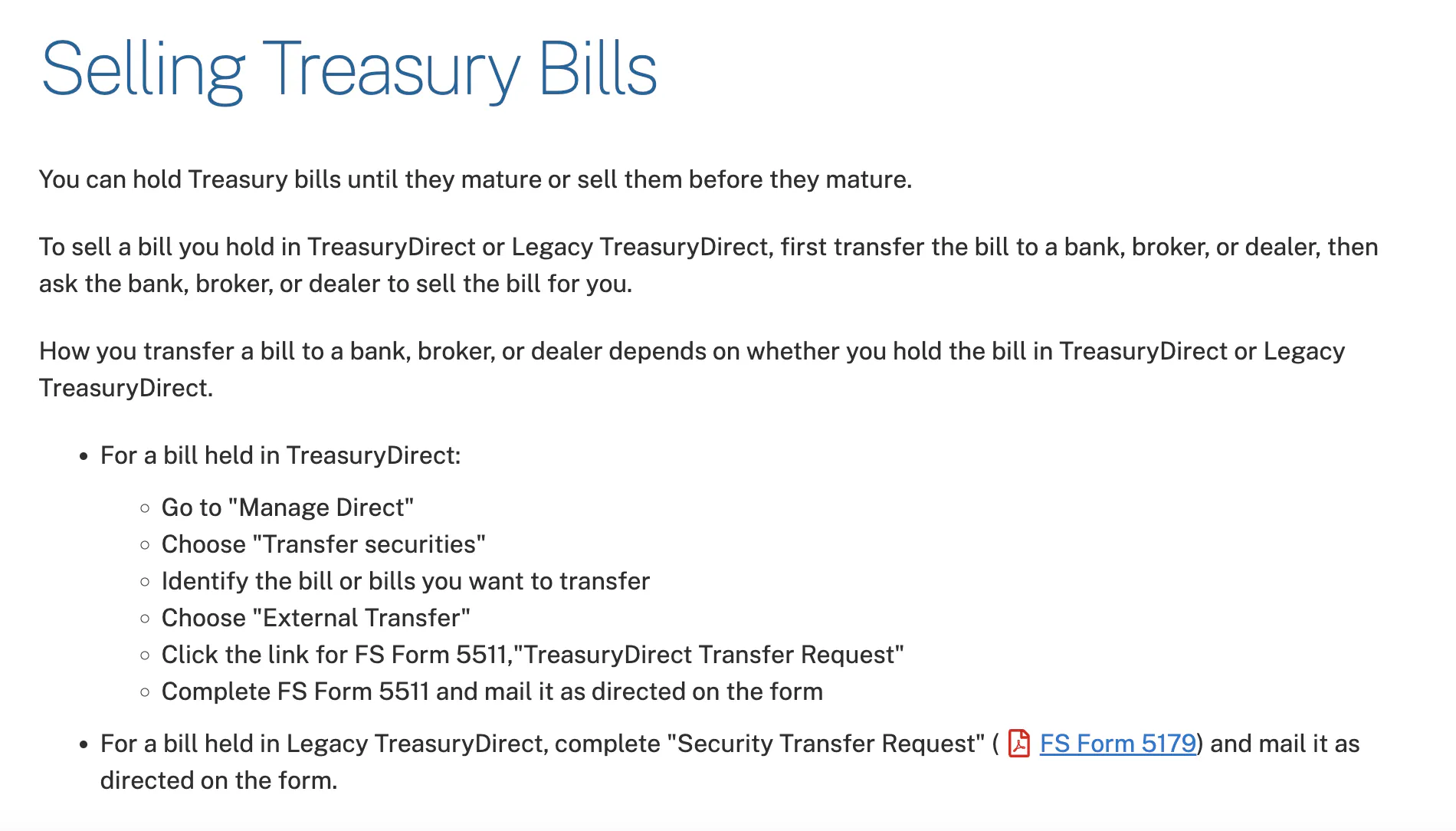

Cumbersome redemptions prior to maturity: Treasurers cannot sell T-bills directly through TreasuryDirect. Instead, treasurers must first transfer the bill to a bank, broker, or dealer, and then ask the bank, broker, or dealer to sell the bill for them.

Screenshot of TreasuryDirect's website showing instructions on how to sell T-bills

Brokerage Firms

Most major financial institutions offer access to Treasury securities through business brokerage accounts. Setting up an account with a brokerage typically involves providing corporate details, banking information, and compliance documentation. Once the account is active, corporate treasurers can place orders for T-bills through a dedicated broker at the firm, or in some cases, a firm’s trading platform, offering a convenient and guided experience for purchasing T-bills.

Noteworthy Limitations When Buying Through a Broker

Fees and commissions: Some brokers charge transaction fees or spreads that may reduce yield. Fees will vary depending on the brokerage firm and should be evaluated by treasurers prior to investing.

Minimums and maximums: Brokers may also impose minimum account balances or require investors to maintain an active trading account. Similarly, some brokers may have limits on amounts per trade, forcing treasurers to initiate multiple trades that may involve multiple CUSIPs they then must manage.

Manual reinvestment: Unless a trade is done at expiry, a treasury team may end up holding uninvested cash, exposed to an underlying bank’s balance sheet for several days, with a potential impact on the return as well. This is particularly problematic if the custodian pays a below-market interest rate on cash balances. It is critical for treasury teams to organize themselves to track all expiries if the broker does not automatically roll positions.

A Simpler Alternative

Jiko offers a smarter way to manage corporate cash, providing transparent pricing, automatic reinvestment, and effortless management. By leveraging Jiko’s innovative platform, treasurers can streamline access to T-bills, minimize hassle, and generate returns.

Price Transparency

Clients can see the yield they’ll receive on a purchase in our dashboard before they buy, enabling informed decision-making. This transparency ensures that investors are not overpaying for their securities and can confidently make purchases knowing they are getting a fair price.

Immediate Reinvestment at Maturity

Jiko automatically rolls client T-bills at maturity and uses the proceeds from the matured T-bill to purchase a new one. This automation helps ensure that corporate cash stays invested and continually generates returns.

Automated Trading and Liquidation

Jiko’s platform simplifies the entire investment process, from purchasing to selling, ensuring that treasurers can use T-bills to manage corporate cash with ease and efficiency. By automating these tasks, Jiko helps save time and reduces the risk of errors associated with manual processing.

How Corporate Treasurers Can Invest in Treasury Bills Wisely: A Step-by-Step Guide

Determine Corporate Cash Allocation

Corporate treasurers should begin by assessing their liquidity needs to determine how much cash should be allocated to T-bills. Considerations include anticipated operational expenses, reserve requirements, and market conditions.

Choose the Best Purchasing Method

Treasurers should evaluate platforms like TreasuryDirect, brokers, and Jiko to determine which method best aligns with their needs.

Monitor Yields & Optimize Corporate Cash Management

Treasurers should actively monitor their yields, reinvest at maturity, and maintain accurate reporting on their investments. Depending on the platform used, reinvesting and reporting can be manual and time-consuming. With TreasuryDirect and brokerage firms, treasurers may need to manually track maturities and reinvest proceeds. In contrast, Jiko automates the reinvestment process and integrates seamlessly with leading treasury management platforms, providing a streamlined and efficient approach to cash management.

Conclusion – Choosing the Best Way to Buy T-Bills for Corporate Treasurers

Choosing the right approach to investing in U.S. Treasury bills is critical for corporate treasurers looking to optimize their cash management strategies. While TreasuryDirect offers direct access without brokerage fees, its manual processes, limitations, and lack of integration can pose challenges. Brokerage firms provide convenience but often come with higher costs and limited flexibility.

For treasurers who prioritize automation, efficiency, and liquidity, Jiko offers a seamless alternative. By enabling direct access to T-bills while eliminating inefficiencies, Jiko streamlines the investment process, reduces manual workloads, and provides enhanced liquidity management. With automated reinvestment options and integrations with treasury management platforms, Jiko ensures that treasurers can optimize their excess cash while maintaining full control over their assets.

As corporate treasurers navigate a complex financial landscape, choosing a T-bill investment solution that balances security, yield, and operational efficiency is essential.

Further reading

How T-Bills Fit Into Corporate Treasury

Especially in today’s elevated rate environment, corporate treasurers are largely seeking its benefits while still maintaining liquidity and protecting principal. Read more →

The 3 Mistakes Corporate Treasurers Are Making When Buying Treasury Bills Directly from a Broker

The savviest treasurers, including Warren Buffet, know that holding core cash in T-bills offers the safest risk profile for risk-free returns. Read more →

4 Questions Treasurers Should Ask Before Investing in a Money Market Fund

Ensuring the safety and liquidity of cash is paramount for treasury teams. Read more →