For corporate treasury professionals who experienced the 2008 financial crisis, the current economic climate likely feels like deja vu. And now, on the heels of the 2023 banking failures, executives are choosing to diversify their cash storage and short-term investments strategy to mitigate risk.

As AFP gets underway next week, these topics are once again at the forefront of finance functions. In this guest-post blog series, we are teaming up with cash-flow management platform Trovata about the importance of protecting and managing a company's cash in any set of market conditions. In this article, Team Trovata explains the importance of cash visibility and insights in a modern corporate treasury environment. See our post on Trovata's blog here, where we outline the importance of expanding the operating principles for cash storage beyond risky leverage and lending to the safety and security of US Treasury bills as an alternative to cash deposits.

With demand for real-time data and cash visibility at an all time high, business executives desire to see increased capabilities in their TMS – improved cash management capabilities top the list of priorities.

To this end, treasurers are being actively confronted with the need to provide real-time insights to support strategic decision-making. Gaining these real-time insights first requires treasurers to unlock operational and financial efficiencies.

In fact, a recent survey by Blackline found that real-time financial data will be “key to survival”. Rising pressures on CFOs will result in more data-reliant decision-making and the need for better cash visibility from treasurers.

The key to keeping up with this heightened demand is by moving away from traditional, manual processes and embracing technology. Incredible technological advances have occurred within the treasury space in recent years and it can empower you to gain better cash visibility via the automation of cash reporting, analysis, and forecasting. It’s now possible to establish a single, comprehensive source of truth for your cash data.

That single source of bank data truth alongside robust cash reporting and forecasting automation tools can enable you to eliminate tedious, manual processes and perform rapid, strategic decision-making with real-time cash visibility.

In this blog post you’ll learn how a modern treasury management platform can lay the foundation you need to build a strong cash storage and investment strategy.

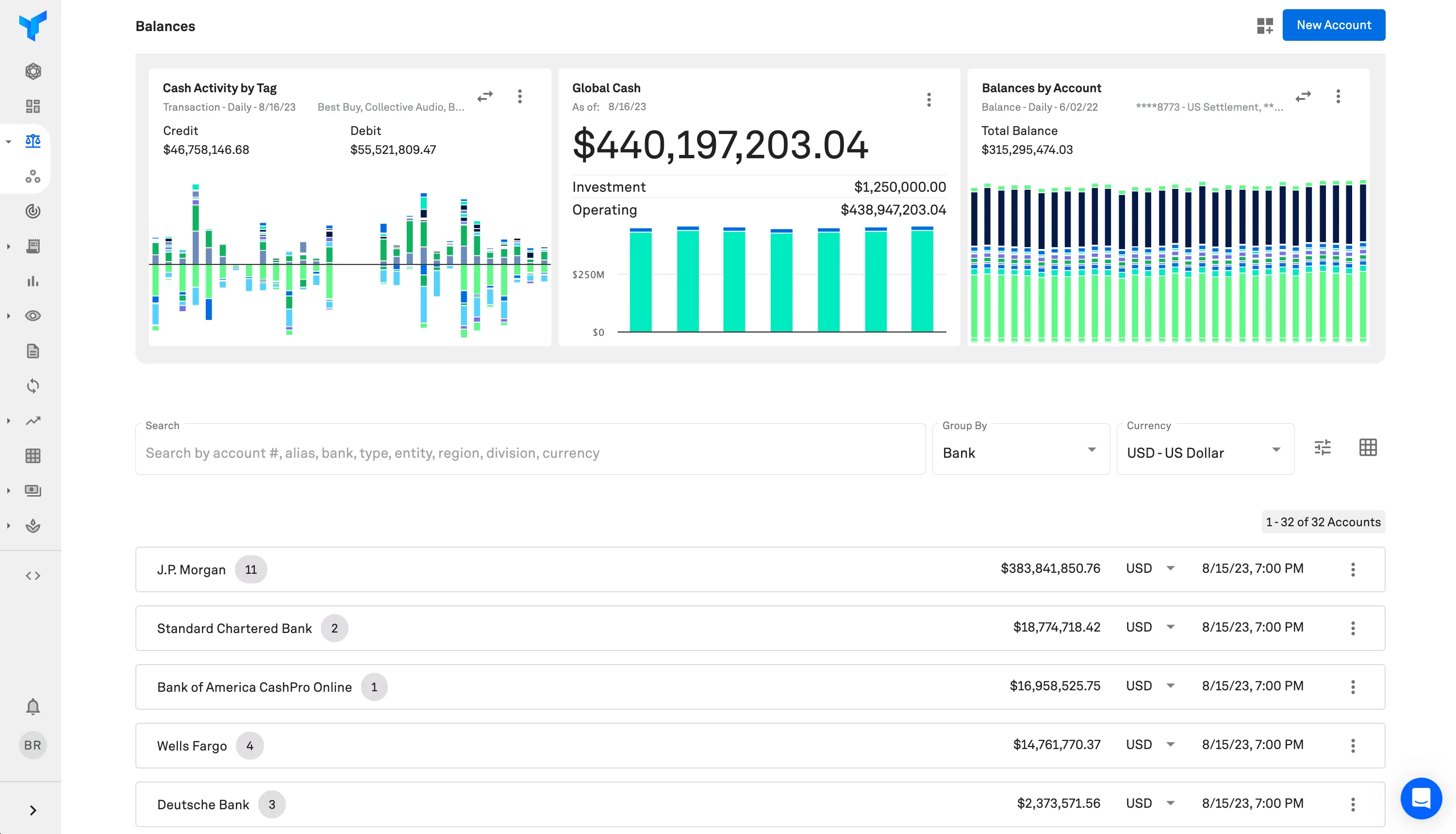

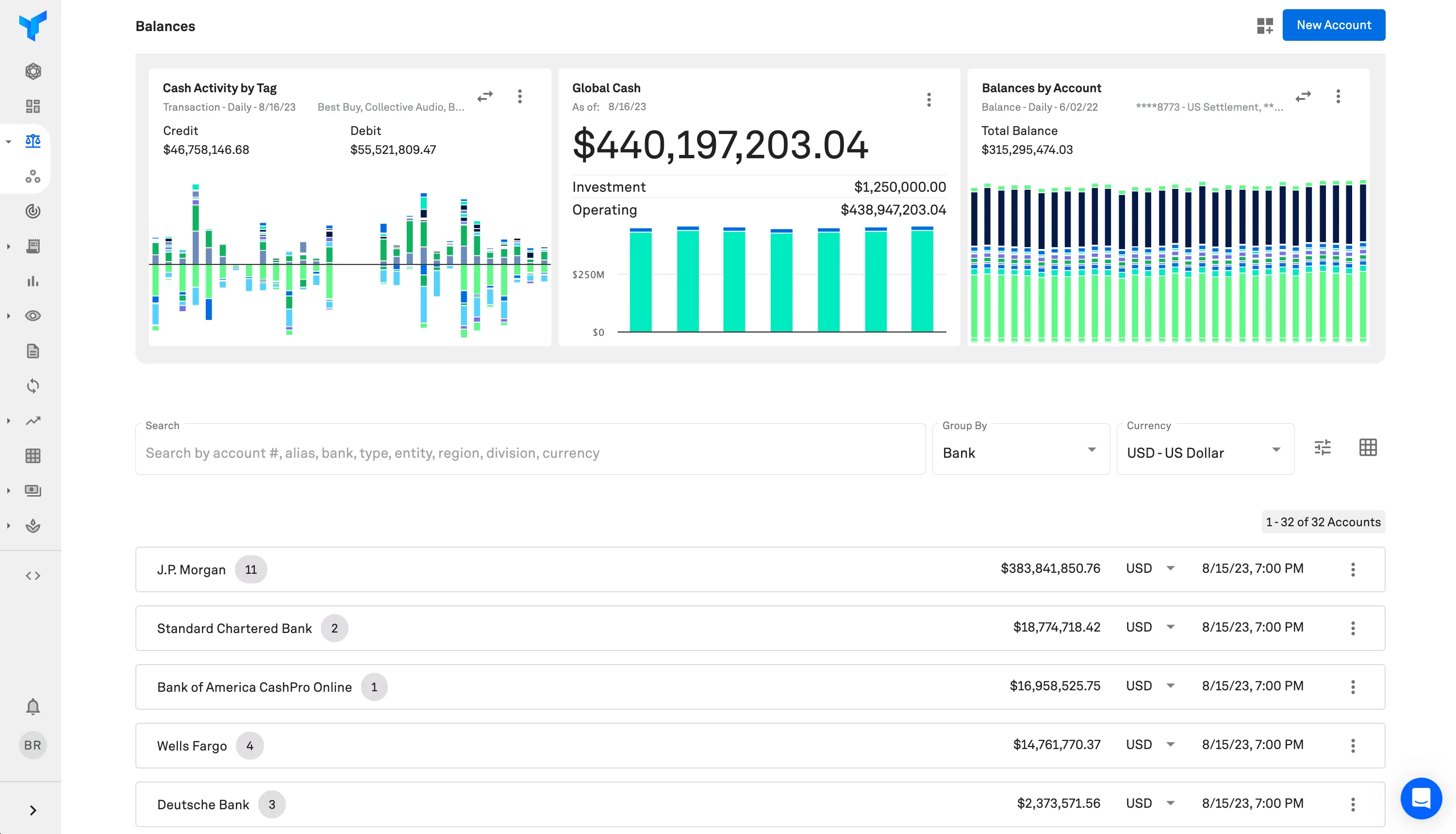

Maximizing Cash Visibility

Let’s face it, far too often treasurers do not have access to their organization’s full cash picture. Complex banking structures that sprawl across regions make it difficult to obtain the level of cash visibility you’re expected to deliver in the current economic climate.

Fortunately, achieving full cash visibility is not an insurmountable goal. Open banking APIs allow treasury management systems to connect directly to your company bank accounts, no matter how many, recording transaction data as they happen.

At this point you may be wondering - how do open banking API’s work to make this possible?

Open banking enables banks to transfer data to clients directly and securely. So instead of normalizing bank data manually and wrangling with spreadsheets, you can gain near real-time cash balance, transactions, and payment tracking in one platform. Rather than spending hours chasing after bank data, open banking brings the data to you in one unified view.

APIs are a way to consolidate and normalize balance and transaction data into a multi-bank data lake, empowering you with a single source of truth for bank and cash data.

Additionally, with a next-gen treasury management platform built in the cloud, your organization can access your bank data in a centralized, financial big data platform. This democratizes data across your organization. All key decision-makers have access to the same data, ensuring analysis doesn’t happen in a silo. As your organization works towards identifying secure cash storage opportunities, this level of democratized visibility will be beneficial for strategic decision making.

However, simply having a complete view isn’t enough to deliver the in-depth insights you’ll need to optimize your cash storage and investments strategy. You need to be equipped with solutions that empower you to instantly view cash by specific categories.

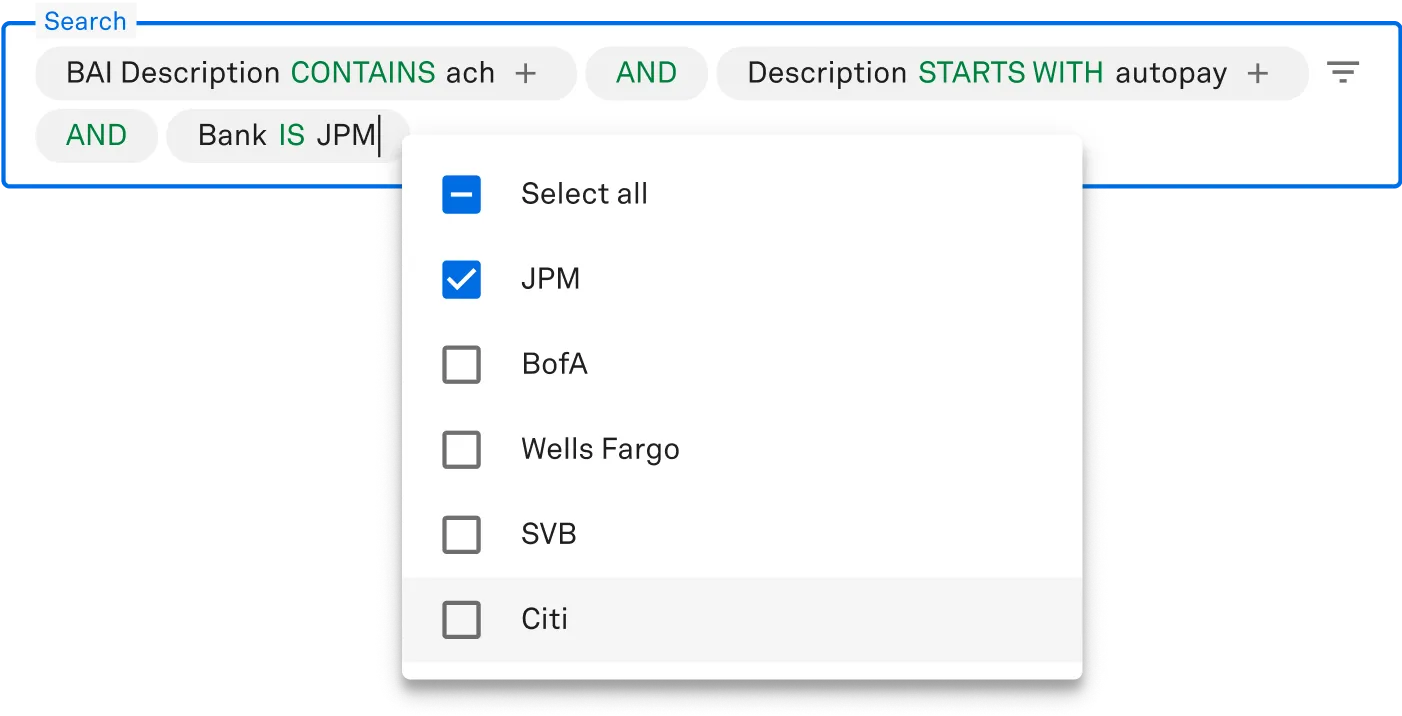

Enhanced Transaction Search

While having one unified view of your liquidity is a game-changer, you need to be able to drill down to specific transactions to keep tabs on cash flow. A modern treasury management platform will provide you with an intuitive experience to quickly and easily search for the transactions you’re looking for.

With an easy-to-use system, you’ll be empowered to create precise searches that can automatically tag your transactions with a cash flow category. Tagging rules are simple to manage and make all transaction activity and reporting comprehensive.

With executives seeking more in-depth data to optimize their cash storage and investment strategy, this Google-like search function will empower you to deliver transactional information your CEO needs to make informed decisions.

Automated Cash Forecasting and Reporting

One of the most important elements of navigating the current economic climate is agility. Your organization needs to make informed decisions and pivot quickly to mitigate risk. Cash forecasting is a pivotal component of risk management. However, the reality is the traditional approach is a slow and manual process.

That’s why it should be no surprise that almost 60% of CFOs plan to invest more in automation throughout 2023. With an open banking API, you can automatically generate cash flow forecasts.

No need to be neck deep in Excel transforming columns in each bank statement and deciding how to categorize and format each transaction. Through AI and machine learning, your historical data is automatically collected and your cash forecasts are continuously updated based on that data.

That means, through AI, your forecasts learn the ebbs and flows of your organization’s transactions. With automated forecasting you’re constantly equipped with up to date, error free projections.

While the 13-week cash forecast is the most critical report you craft and monitor, there’s a number of other reports that can help you optimize your cash storage and investment strategy. These include:

Total closing average cash - Monitoring your total closing average cash across your global bank accounts is critical as it provides a detailed look into whether your organization is utilizing its cash effectively. This can help you identify which bank accounts are best serving you and where there may be opportunities to withdraw and move your cash to a more secure cash storage option.

Share of wallet - Share of wallet refers to the percentage breakdown of your total cash by bank account. Having this percentage breakdown can help you gain a better understanding on where most of your cash reserves are stored and where you can reallocate cash.

An open banking API arms you with a comprehensive suite of automated cash reporting and forecasting functionality powered by artificial intelligence and machine learning technology. You’ll be able to gain new insights beyond the limitations of traditional reporting. With demand for data at an all time high for finance functions, being equipped with these solutions will help you mitigate risk and identify the right opportunities for your organization.

Gain Unmatched Cash Visibility with Trovata

Laying the foundation for your cash storage and investments strategy requires maximizing your cash visibility. Trovata makes it easy to automate cash reporting, forecasting, analysis, and money movement - giving you the visibility you need to better mitigate risk. By bridging the gap between banks and accounting systems, Trovata helps companies gain powerful insights into their cash flows and facilitate better and quicker business decisions. In addition, as a next-gen technology platform, Trovata is helping many of the world’s largest financial institutions digitally transform commercial and corporate banking with its growing network of direct API integrations.

By automating your cash management, you can ensure your organization has a tighter handle on cash across all your key accounts. Pairing your bank data with new technologies, such as AI and ML, can present new insights no human could ever imagine discovering. Trovata enables you to effortlessly identify idle cash, so you can make highly informed storage decisions to maximize your organization’s cash flow efficiency.

Written by

Trovata